10 Most Expensive Acquisitions In Recent Tech History

By Singyin Lee, Hongkiat.com, 27 February 2014.

By Singyin Lee, Hongkiat.com, 27 February 2014.

There are many reasons why tech acquisitions happen: to acquire talent, to shut down a rising competitor, to gain access and ownership to patents, equipment, technologies etc., and at the very least, it is great fodder for the media. These acquisitions usually come with a hefty price tag, but the truth is that not all of them have good ROI.

Despite the mind-boggling sum of US$19 billion, Facebook buying WhatsApp may not exactly be the biggest acquisition in known history (see here for some of the biggest numbers in a variety of relatable categories).

In today’s post, we’re counting down the biggest billion-dollar acquisitions that has happened in recent years. Just for fun, we’re throwing in what else you could buy for the same price tag (just to put things into perspective).

Recommended Reading: 40 Classic Photos Of Tech Companies You’ve Got To See

1. Facebook Buys WhatsApp (US$19 billion)

Image Source: South China Morning Post

For the ridiculous price of US$19 billion, Facebook is buying more than just an app. Facebook is getting access to WhatsApp’s 450 million users, minus the 500,000 that have migrated to Telegram, and the 200,000 to Threema, and countless other migrations that nonetheless aren’t even touching the grand bulk of users sticking to WhatsApp.

If anything killed SMS, it was WhatsApp with its handy, dependable and professional approach to mobile messaging, so much so that SingTel CEO is considering charging the likes of WhatsApp and Skype for the use of their networks. WhatsApp also spurred a motherload of alternatives, and many new ones are recently coming out from China to take a chunk of the mobile messaging market.

2. Google Buys Motorola Mobility (US$12.5 billion)

Image Source: Yahoo! Finance

Before Facebook made the deal of the decade though, Google held that crown with an acquisition of Motorola Mobility in 2011 (finalised in 2012) for US$12.5 billion. From the deal, Google secured a bargaining chip against Apple in the form of 17,000 patents including patents for wireless communication technologies.

Earlier in mid-2011, Google had also acquired 1000 IBM patents mostly related to hardware but lost out on 6,000 patents in telecommunication and networking patents from Nortel. Nortel had sold out to a group of tech companies including Apple and Microsoft, instead of only to Google, raking in US$4.5 billion in the process.

Google had since sold off Motorola Home for US$2.35 billion and Motorola’s smartphone division (plus 2,000 patents) to Lenovo for US$2.91 billion but in return had triggered and aided in the fascinating growth of Android at an unprecedented scale.

3. HP Buys Autonomy (US$10.3 billion)

Image Source: LA Times

After having bought Compaq for US$17.6 billion in 2002, HP was on course to make another US$10-billion sale with Autonomy, an enterprise software company, in 2011. Later, near the end of 2012, HP admitted that they had overpaid for the company, citing the reason being Autonomy had been cooking their books (which they denied).

A write-down of US$8.8 billion was reported, US$5 billion of which they said was caused by the accounting discrepancies. HP executives reportedly knew about the British software maker’s inappropriate accounting activities yet did not inform the board, allowing the deal to slip through.

The CEO in charge, of the deal, Leo Apotheker, had since been sacked, and when Autonomy failed to reach revenue targets, its founder and CEO, Mike Lynch was fired as well. Lynch who had built Autonomy for 10 years, denied the allegations and instead puts the blame on petty infighting in HP. With everyone pointing fingers at everyone, the fight is far from over.

4. Microsoft Buys Skype (US$8.5 billion)

Image Source: The Guardian

Before Microsoft bought Skype in mid-2011, Skype was briefly owned by eBay in 2005 for US$3.1 billion. EBay sold it off to a private investor at a 40% loss but when Google and Facebook came a-knocking, Microsoft swooped in and welcomed Skype into the family for US$8.56 billion. Although it had a smaller user base than Windows’s own Live Messenger (roughly a third at the time of the acquisition), Skype had 8 million paying customers.

Since then, Skype is pre-installed on every Windows device and is the channel one-third of the world’s video calls are on. It also brought in close to US$800 million in 2012, which hardly contributed to Microsoft’s overall earnings, but it is still a lot better than Microsoft’s acquisition of online advertising company, aQuantive in a 2007 US$6.3 billion deal. Let’s just say online advertising is still out of Microsoft’s grasp.

5. Oracle Buys Sun Microsystems (US$7.4 billion)

Image Source: Investors.com

Upon buying Sun Microsystems, Oracle took over ownership of Java, the Solaris Operating System and MySQL (considered a threat to Oracle’s business), which Sun had bought two years prior for US$1 billion. The move effectively kept Java away from IBM’s clutches but saw the loss of key engineers in Sun, including creator of Java, James Gosling, creator of XML, Tim Bray, CEO Jonathan Schwartz and Sun’s Chief Open Source Officer, Simon Phipps.

In August 2010, Oracle, locked and loaded, sued Google for "copyright and patent infringement" over the use of Java in its Android platform. It was looking for US$6.1 billion in damages but when a jury found that Google was not guilty of infringement, only "a small amount of literal code copying", Oracle agreed to "zero" damages, saying it wants to focus on filing for an appeal instead.

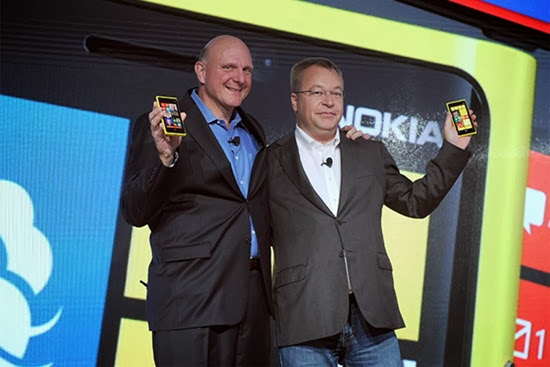

6. Microsoft Buys Nokia (US$7.2 billion)

Image Source: The Verge

Once the no. 1 cell phone manufacturer in the world, Nokia sold its mobile phone unit to Microsoft for more than US$7 billion in mid-2013. Also included are Nokia’s patent portfolio, mapping services, around 32,000 employees and a chance for Microsoft to break into the mobile device and services market via the Lumia and Asha brands.

Conspiracy theorists quickly noted the involvement of Stephen Elop in the decision to merge Nokia’s hardware and distribution channels with Microsoft’s Windows Phone platform. Previously an executive of Microsoft, Elop was CEO at Nokia during the acquisition and will become the head of Microsoft’s devices team upon completion of the deal.

Another theory was that Nokia was at the verge of dumping Windows Phone and Microsoft had no other choice but to buy the one last vessel that carry Windows Phone.

7. Google Buys Nest Labs (US$3.2 billion)

Image Source: Business Insider

What in the world could Google possibly want with thermostats and smoke detectors when it already is the world’s biggest search engine, and has an array of news-generating products - Chromecast, Chromebook, Android OS, Google Nexus and Google Glass - to its name? Possibly the next big thing to change the world.

The co-founder of Nest is none other than Tony Fadell, creator of the iPod and he is set to change your home into a "conscious home". Google believes that technology should be working hard for people, while people should be getting on with their lives. Nest’s products aim to make that a reality, by creating smart products that can make decisions by learning your behaviour and interacting with you, inside your home. Creepy…yet exciting!

8. Dell Buys Quest Software (US$2.4 billion)

Image Source: John Anthony Signs

Quest Software is a leader in enterprise software solutions comprising of database management, data protection, Windows server management as well as identity and access management. In light of the decline in hardware and personal computer sales, Dell outbid rivals with a US$2.4 billion offer to acquire Quest.

It hopes to push its software business sales to up to US$1.2 billion per annum with the help of Quest, which has 3850 employees and 60 offices in 23 countries. Dell is also reported to have made 19 acquisitions in the past 4 years including for a storage protection solution company, Credant Technologies (undisclosed), and a network and data security provider, SonicWall for US$1.2 billion.

9. Yahoo! Buys Tumblr (US$1.1 billion)

Image Source: Business Insider

Marissa Mayer joined Yahoo! in July, 2012 and began a shopping spree that involved a variety of start-ups including Rockmelt, Aviate and the one with the biggest price tag, Tumblr. So far, it has shown no signs of slowing down. It is home to 173.4 million blogs and already has 78 billion posts. Tumblr is essentially Yahoo’s lifeline to young adults, and while Tumblr has yet to show any returns, Mayer could change all that with ads in 2014.

Aside from trying to figure out how to monetize ads in a way that doesn’t take away from the Tumblr user experience, Yahoo has to deal with Tumblr pages that are not safe for work (NSFW). For the former, it is possible that another start-up company, Swoop, may be called in to deliver. Using data provided by the users themselves, Swoop engages in contextual advertising to ensure you are served ads of things you are interested in. Check this post for more details.

10. Facebook Buys Instagram (US$1 billion)

Image Source: Bloomberg

After all that, Facebook buying Instagram, a photo-sharing app for a billion dollars (pfft) sounds like child’s play (perspective, right?). In any case, Facebook has been buying start-ups left, right and centre mostly to acquire new talent, and like how Google does it, a lot of these acquired start-ups are bought then shut down (Snapchat knew what was coming).

One of the exceptions, however, was Instagram. Since the acquisition in April 2012, Instagram has a marked growth of 23% in 2013 and has announced that it would be introducing advertising to the platform. Possibly the most influential app to popularize selfies and hashtags, Instagram’s fame had also spurred many third-party apps that allow users to extend Instagram beyond its use of photographic filters.

No comments:

Post a Comment

Please adhere to proper blog etiquette when posting your comments. This blog owner will exercise his absolution discretion in allowing or rejecting any comments that are deemed seditious, defamatory, libelous, racist, vulgar, insulting, and other remarks that exhibit similar characteristics. If you insist on using anonymous comments, please write your name or other IDs at the end of your message.