Are these ominous signs in the already bleak global economic scenario? These are the sort of news you won’t find much in the western mainstream media. Read and judge for yourself…

BRIC NATIONS (BRAZIL, RUSSIA, INDIA, CHINA AND SOUTH AFRICA) SIGNED LOCAL CURRENCY AGREEMENT AT SUMMIT. THEY WILL NOT TRADE IN U.S. DOLLARS ANYMORE. AGREEMENTS AROUND THE WORLD BETWEEN COUNTRIES TO DROP U.S. DOLLAR FOR TRADE (INCLUDING AUSTRALIA)

By Sherrie Questioning All, 29 March 2012.

By Sherrie Questioning All, 29 March 2012.

The BRIC nations (Brazil, Russia, India, China and South Africa) signed an agreement to not trade in U.S. dollars anymore, but in their own currencies. They are even working on creating their own bank for trading between each other and to handle the currencies, besides lines of credit in the currencies. BRIC nations account for half of the world's population.

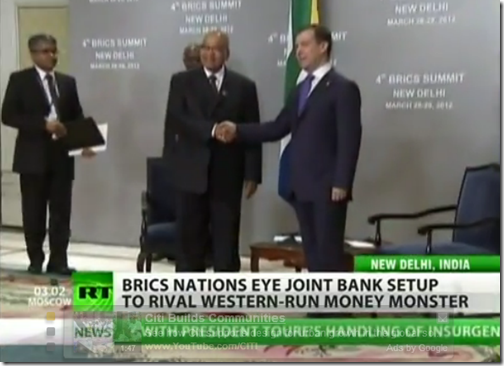

New Delhi: In an initiative to promote trade in local currencies, the BRICS nations today signed two agreements to provide line of credit to the business community and decided to examine the possibility of setting up a development bank on lines of multilateral lending agencies. The agreements were signed by officials of five countries - Brazil, Russia, India, China and South Africa - at the fourth BRICS.

"The agreements signed today by development banks of BRICS countries will boost trade by offering credit in our local currency," Prime Minister Manmohan Singh said in a media statement after the meeting. The Master Agreement on Extending Credit Facility in Local Currency and the Multilateral Letter of Credit Confirmation Facility Agreement are being perceived as a step towards replacing the dollar as the main unit of trade between them.

As regards the initiative to set up a BRICS Development Bank on the lines of multilateral lending agency, Singh said the proposal would be examined by the finance ministers.

"A suggestion has been made to set up a BRICS development bank, we have directed our FM to examine the proposal and report back by next summit," Singh said.

The initiative to set up a BRICS Development Bank on the lines of the World Bank would allow the member countries to pool resources for infrastructure development and could also be used to lend during the difficult global environment.

Intra-BRICS trade is about USD 230 billion and has the potential of more than doubling to USD 500 billion by 2015...

The countries are the largest developing countries in the world. The dropping of the U.S. dollar will affect us especially since the U.S. is printing dollars non-stop.

Considering that Saudi Arabia and China have entered into an agreement to build a mega oil refinery worth 8.5 Billion last week, who knows how long the dollar will remain the "Petro dollar". Iran stopped trading oil for dollars on March 20th.

Media reports suggests that India has agreed to pay the price of crude oil it imports from Iran in gold, which makes it the first country to drop the US dollar for purchasing the Iranian oil.

India, which is highly dependent on imports to meet its crude oil consumption needs, is Iran’s second-largest oil customer after China and purchases around $12 billion worth of Iranian crude every year, about 12 percent of its consumption.

Iran is one of the world’s leading producers of both natural gas and oil; it is OPEC’s second-largest oil producer and exporter after Saudi Arabia and, in 2010, was the world’s third-largest exporter of oil after Saudi Arabia and Russia.

Last week, the Tehran Times noted that the Iranian oil bourse will start trading oil in currencies other than the dollar from March 20.

Do not forget even Australia (a stanch U.S. ally) has made an agreement with China on March 23 2012, to trade in the Chinese Yuan and not the U.S. dollars for $30 billion over 3 years time.

Mar. 23 – The central banks of China and Australia signed a currency swap agreement yesterday that will allow RMB200 billion (A$30 billion) worth of local currencies to be exchanged between the two countries over three years.

The purpose of the agreement, according the People’s Bank of China, is to help strengthen financial cooperation between the two sides, boost bilateral trade and investment, and promote regional financial stability.

“The agreement reflects the increasing opportunities available to settle trade between the two countries in Chinese renminbi and to make RMB-denominated investments,” the Reserve Bank of Australia said in a press release.

If Americans think they are immune to hyperinflation due to the dollar being the reserve currency of the world, then they have not been paying attention. The facts are the dollar is being dropped all around the world as the trading currency and countries are trading in local currencies or the Chinese Yuan/renminbi.

Americans have been sheltered from inflation unlike the rest of the world, due to the dollar being the reserve currency. Americans think the U.S. will remain strong and protected from all the printing the Federal Reserve has been doing and since most only listen to MSM. Those who have not been paying attention and only listen to the government and the controlled talking heads on TV will not have insulated themselves and protected their dollar value at this time.

The Federal Reserve has gotten away with printing Trillions in new dollars and making secret loans to banks for the last few years, without the U.S. citizens hurting too badly through inflation due to it. There has been inflation but not the amount that it would have been if the dollar was not the reserve currency of the world during that time.

The propping up of the stock market and the manipulation of metals through throwing newly printed money and what ever it has taken by the Federal Reserve will be uncovered at some point when inflation hits the U.S. that is uncontrolled. As countries around the world stop using the dollar and the Federal Reserve can't hide all the printing and funnelled money to falsely prop up markets and give money to Wall Street to manipulate metals, situations can/will get ugly in the U.S.

When people can't afford a gallon of gas or milk due to the prices, that is when many may wake up from their slumber and not be happy and do desperate things to get what they need. When that happens the blame will be entirely on the Federal Reserve and the Federal U.S. government for allowing the debasement of the U.S. dollar and non-stop printing. How long will this take? I guess it all depends on how fast countries around the world drop the dollar and enact their trade agreements between their own currencies and the Chinese Yuan…

Video: BRICS to change world economy

Source: RT America Channel on YouTube

The BRICS countries' leaders are preparing for their annual meeting. These countries make up 42 percent of the world's population and a quarter of its landmass. They are also responsible for 20 percent of the Global GDP and own a whopping 75 percent of the foreign reserve worldwide. In these tough times for world economics these countries are trying to find a solution for the situation. RT's Priya Sridhar gives us a sneak peak of the summit from India.

No comments:

Post a Comment

Please adhere to proper blog etiquette when posting your comments. This blog owner will exercise his absolution discretion in allowing or rejecting any comments that are deemed seditious, defamatory, libelous, racist, vulgar, insulting, and other remarks that exhibit similar characteristics. If you insist on using anonymous comments, please write your name or other IDs at the end of your message.