The above pictures depict the capitalist system or simply capitalism – the system that is practised by, and entrenched in, the western world and other nations that in one way or another embrace it. The system is hierarchical in nature, hence it’s often referred to as a pyramid system or scheme. Both pictures refer to capitalism as a pyramid scheme. The image on the right is in fact a 100-year old political cartoon - and it's still as accurate as ever in depicting capitalism. The pyramid scheme is also referred to as the Ponzi scheme.

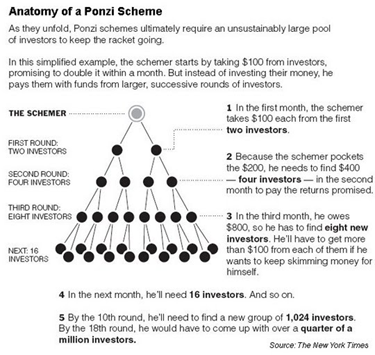

The Ponzi scheme may be alien to some people in our country, but think Multilevel Marketing (MLM) and they should be get the idea. The most common MLM scams are in fact pyramid schemes. Many of our people have been involved – and have suffered greatly – from illegal MLMs because of the scheme’s basic premises. The following infographic illustrates nicely the anatomy of the Ponzi scheme.

Source: The New York Times

Such a scheme that do not offer any value other than the pyramid system (i.e. passing money upwards) is simply not sustainable.

The Ponzi scheme is illegal, yet the pyramid-based capitalist system - as a state system - is still legal worldwide. The Ponzi scheme parallels the economic and financial systems of the US and Europe and other follower nations. The unsustainability of such a system is what is causing the current economic crisis. The following article explains further.

THE DANGER DEBT POSES TO THE WESTERN WORLD

By Alexander Jung, De Spiegel, 5 January 2012.

Countries around the world, particularly in the West, are hopelessly in the red, with debt rising every day. Even worse, politicians seem paralyzed, unable - or unwilling - to do anything about it. It is a global disaster that threatens the immediate future. But there might be a way out.

The Ponzi Scheme

When Carlo Ponzi, a dishwasher from Parma, Italy, immigrated to the United States in 1903, he had $2.50 in his pocket and a million-dollar dream in his head. He was able to fulfill that dream, at least temporarily.

Carlo Ponzi

Ponzi promised people that he would multiply their money in a miraculous way: by 50 percent in six weeks. With his carefully parted hair and charming accent, Ponzi beguiled investors and fueled their avarice. The first investors raked in fantastic returns. What they didn't know was that Ponzi was simply using the next investors' money to pay them their profits.

The scheme continued. Ten investors turned into 100, and 100 investors turned into 1,000, until the scam was discovered. Ponzi spent many years in prison, and he died a pauper in 1949. But his name remains important to every criminologist today - and every economist.

Economists use the term "Ponzi scheme" to describe a disastrous mechanism in which someone pays off old debt by constantly taking on new debt. The repayment of the debt - the most recent loans, plus interest - is deferred into the distant future, fueling an eternal process of debt refinancing.

It's the classic pyramid, or snowball scheme, practiced by thousands of con artists after Ponzi. The most spectacular case was that of New York financier Bernard Madoff, who was responsible for losses of about $20 billion by 2008. Snowballs are set into motion, becoming bigger and bigger as they roll along. In the worst case, they end in an avalanche that takes everything else with it.

Bernard Madoff and his Ponzi scheme

Western economies have not acted much differently than the fraudster Madoff. In 2011, they were virtually inundated with bad news and old sins. Almost everyone - in Europe and in the United States - has been living beyond their means, from consumers to politicians to entire countries. Governments have become servants to the markets upon which they have become dependent.

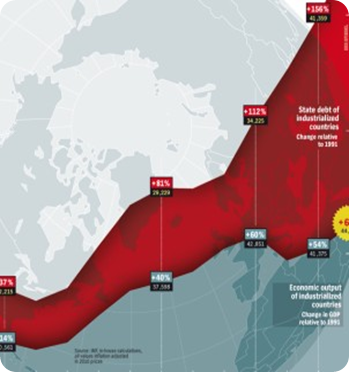

Debt in the industrialized world

Bigger Snowballs

On an almost weekly basis, the reports have become more worrisome and the sums of money involved more staggering. Many are now concerned that, as 2012 begins, the snowballs will only get bigger - and roll faster:

1. There are the banks in Europe, which will have to repay about €725 billion in combined debt in 2012, including €280 billion in the first quarter alone. With the private market largely off-limits to them, the banks have had to rely on the European Central Bank (ECB) to bail them out. The ECB is now lending them fresh money - as much as they want - at minimal interest rates.

2. There is a country like Italy, which has an exorbitant amount of debt to service at the beginning of the year. About €160 billion in debt will mature between January and April; the total for the entire year is about €300 billion. The government in Rome is already having trouble finding buyers for its bonds.

3. There is the ECB, which is creating billions essentially out of nothing. On an almost weekly basis, it is acquiring bonds that no one else would buy from Portugal, Spain and Italy and, in the process, it is turning into a reluctant financier of nations. This financial aid already amounts to €211 billion.

4. There is the European Commission, whose president, José Manuel Barroso, supports the use of so-called euro bonds. These bonds, which would be issued jointly by the countries in the monetary union, would amount to an accumulation of collective debt on top of national debts.

5. There is the €440-billion euro bailout fund, of which €150 billion are already promised to Greece, Ireland and Portugal. But because this amount is still not enough, the finance ministers have decided to "leverage" the fund, a seemingly harmless term for bringing in additional lenders, thereby multiplying the volume of credit.

6. And then there is the United States, which only remains solvent because the Congress in Washington keeps raising the debt ceiling. The American government already owes its creditors about $15 trillion.

Fractional Reserve Banking based on pyramid scheme

In other words, there are plenty of snowballs that have started rolling and getting larger with each rotation. Some aspects of the economic system in the industrialized countries resemble a gigantic Ponzi scheme. The difference is that this version is completely legal.

Living on Credit

Old debts are paid with new ones, with borrowers giving not the slightest thought to repayment. This has been going on for a long time, far too long, in fact. It was only with the eruption of the financial crisis in 2007 and the outrageously expensive bailouts of banks and economies that many people realized that the entire world is living on credit.

Per capita debt in selected countries

"Debt is rising to points that are above anything we have seen, except during major wars," economists at the Bank for International Settlements (BIS) concluded in a recent study. "The debt problems facing advanced economies are even worse than we thought."

This is even true of seemingly rock-solid Germany. In the third quarter of 2011, German public debt amounted to €2.028 trillion, an increase of €10.8 billion over the debt level just three months earlier. Germany's public debt grew by about €120 million a day - or more than €80,000 a minute - between July and September.

Germany's sovereign debt

To make matters worse, this increase occurred in a quarter marked by plentiful tax revenues and a significant decline in unemployment. But debts increase independently of whether times happen to be good or bad.

The End of the System

The same thing is happening almost everywhere. In the first decade of this century, which was by no means a weak period economically, countries more than doubled the level of debt - to an estimated grand total of $55 trillion by the end of 2011.

The United States leads the pack with its national debt of $15 trillion, followed by Japan with about $13 trillion. Germany's €2 trillion looks almost paltry by comparison. Today, the three major rating agencies award their highest credit rating to only 14 countries in the world.

The fact that nations are continually spending more than they take in cannot turn out well in the long run. The word "credit" comes from the Latin "credere," which means "to believe." The system will only function as long as lenders believe in borrowers. Once the belief in the creditworthiness of borrowers is destroyed, hardly anyone will be willing to buy their securities.

When that happens, the system is finished.

This is precisely what happened with Carlo Ponzi's scheme. And now entire countries are suffering suspiciously similar fates. They are no longer being taken seriously.

Greece is effectively insolvent. Italy and Spain are forced to offer higher interest rates to find buyers for their government bonds. And France threatens to lose its impeccable credit rating. The debt crisis has arrived in the heart of Europe.

Meanwhile, it is also flaring up in the United States once again, with Democrats and Republicans blaming each other for the nation's debts. Instead of taking responsibility and consolidating the budget, President Barack Obama prefers to rail against the Europeans' approach to crisis management. They, in turn, refuse to tolerate any interference, especially from the United States, which they blame for being the source of the financial crisis in the first place.

In this fashion, the Old World and the New World are tossing the blame back and forth, while confidence in politics and its ability to avert collapse is dwindling on both sides of the Atlantic. Is there still a way to stop the avalanche, or at least to diminish is destructive force? Why do countries that collect taxes have to borrow money in the first place?

[Source: Der Spiegel. Edited. Some images added.]

No comments:

Post a Comment

Please adhere to proper blog etiquette when posting your comments. This blog owner will exercise his absolution discretion in allowing or rejecting any comments that are deemed seditious, defamatory, libelous, racist, vulgar, insulting, and other remarks that exhibit similar characteristics. If you insist on using anonymous comments, please write your name or other IDs at the end of your message.